Compulsory Dematerialisation of Shares

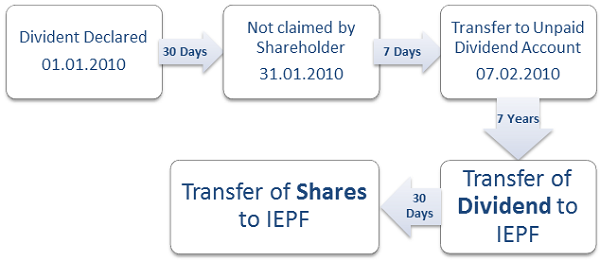

Under the erstwhile Act, there was no requirement to transfer the shares for which the dividend is unpaid or unclaimed to the IEPF. However, with the enforcement of the corresponding section, i.e. 124 (6) under the Act, 2013, every Company is mandatorily required to transfer the underlying shares for which the dividend has remained unpaid or unclaimed for a consecutive period of seven years.

Accordingly, as per section 124 (6) of the Act, 2013 the underlying shares of unpaid or unclaimed dividend are also required to be transferred to IEPF apart from the amount of unpaid or unclaimed dividend.

Securities Exchange Board of India has recently notified to discontinue physical transfer of shares ineligible w.e.f. 1st April, 2019. With that, conversion of securities in physical form to dematted shares has become complusory. The shareholder will have to surrender his physical certificates to convert them into electronic form which will be credited directly into the demat account of the concerned shareholder. We will help you in this entire process from start to end till the shares are credited in your account. We shall keep the entire process transparent and to the knowledge of the shareholder so that he is aware of the status of his securities.

© 2019 - S.P. Investments | Powered by Systron